“Ally Bank’s mobile app exemplifies the future of banking. With its user-friendly interface and comprehensive features, it’s no wonder Ally has become a leader in the industry.”

– Chris Hogan

Want to know what the mobile banking app development cost? You should read this blog to the end. Digitalization is changing the world, so it’s no surprise that modern banking involves digital or mobile banking.

Since the beginning of time, traditional banks have offered products and services. Banking services have been bound to local branches for a long time, so the customer had to visit them to do everything. There was a new wave in app development after the advent of mobile apps and the internet.

Today, there are now more than two billion online bankers and mobile banking users. One hundred and thirty-three million of those are in the United States of America. The number is expected to reach $1.8 billion, with the increase in tech integration and growth.

These types of loans are popular with the younger generation. The most frequent users of banking apps are those aged 25-34. More than 97% of millennials today use mobile banking apps. The user experience is amazing. But from a commercial perspective, it’s even more amazing.

Allied Market Research reported that the mobile banking market reached $715.3 in 2018 but is expected to grow to $1,824.7 million by 2026. It’s amazing how much revenue can be generated. Some of the world’s leading banks developed their mobile banking apps to save and generate revenue.

Determining the mobile banking app development cost is the hardest part of creating a fintech mobile app. If you’re looking for something similar, this blog is the place for you.

We will discuss everything about mobile banking apps, including their cost and features. So, now that we’ve established this let us begin.

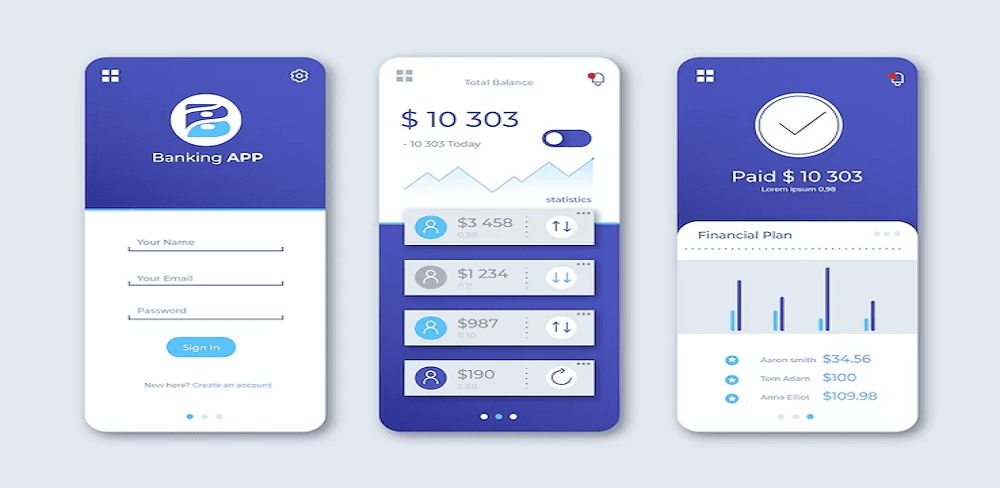

What is a Banking App?

Banking apps are mobile applications that allow customers to manage and access their bank accounts, credit cards, and other financial services using their smartphones and tablets. These apps provide users with an easy and secure way to view account balances, make transfers, pay bills, and more.

Users may protect their financial and personal information by using banking applications. They include fingerprint or facial recognition, two-factor verification, and encryption to prevent unauthorized access.

The solutions made life easier for everyone. Most banks have also used mobile app development services to create their banking applications.

Why Invest in Mobile Banking App Development?

- In the United States, the number of downloads of mobile banking apps will decrease toward the end of 2022. The number of mobile app downloads decreased from the previous record of 40.1 million in the fourth quarter of 2022 to 34.6 million.

- Capital One Mobile, with over 10,000,000 downloads in 2022, was the top banking app in the United States. Chase Mobile by JPMorgan Chase, the banking app of JPMorgan Chase, was ranked second with a total download of approximately 8.9 million.

- In France, the number of downloads of mobile banking apps peaked at 5.4 million in the fourth quarter of 2022.

- Mobile banking users in the U.S. rated receiving alerts regarding unusual account activity as the second most valuable feature.

- Chime is the largest mobile banking service provider in the United States. Chime had 5,8 million monthly users (MAUs).

How Does Mobile Banking App Work?

Mobile banking apps provide a convenient and user-friendly way to access and manage your finances from your smartphone or tablet.

The process starts by downloading the mobile banking app provided by your bank from the app store and logging in using your online banking credentials. After logging in, you may examine your account balances and transaction history and make transfers across your accounts.

When you build mobile banking apps, it will allow you to pay bills, deposit checks by capturing their images, and send money to other individuals or businesses. To safeguard your personal and financial information, the app uses authentication and encryption techniques to assure security.

Notifications can be set up to alert you about important account activities or transactions. Some mobile banking programs also provide extra services, including loan applications, investment management, and budgeting tools.

Top 5 Examples of Mobile Banking Apps

| Mobile Banking App | Available Platform | Downloads | Ratings |

| Chase Mobile | Android | iOS | 10M+ | 4.4 |

| Bank of America Mobile Banking | Android | iOS | 10M+ | 4.6 |

| Ally | Android | iOS | 1M+ | 3.7 |

| Capital One Mobile | Android | iOS | 10M+ | 4.6 |

| Wells Fargo Mobile | Android | iOS | 10M+ | 4.8 |

1. Chase Mobile

Chase Mobile, the mobile banking application offered by JPMorgan Chase – one of the biggest banks in the United States – is a great way to manage your finances. It offers many features, including checking account balances and transferring funds. You can also pay bills, deposit checks, or transfer money by photo-taking.

2. Bank of America Mobile Banking

Bank of America offers a mobile banking app that allows users to track their spending, manage their accounts, pay their bills, and send money to their friends and families. The app also includes features such as ATM and branch locations and the option to temporarily lock and unlock debit and credit cards.

3. Ally

Ally Mobile, the mobile banking application offered by Ally Bank, allows users to check account balances, transfer money and find nearby ATMs. Users can check their account balances and transfer money. They can also find ATMs nearby, deposit checks, manage investments, and locate nearby ATMs. Users can also receive real-time notifications and have access to customer service. So if you want to invest in Ally app development, you should hire mobile app developers.

4. Capital One Mobile

Capital One Mobile, the mobile banking application offered by Capital One, allows users to view account balances, pay bills, and transfer funds. Users of the app may transfer money, deposit checks, make payments, and check account balances. Additionally, it provides features like tailored spending insights, virtual card numbers for added protection, and credit score monitoring.

5. Wells Fargo Mobile

Wells Fargo Mobile, the mobile banking application provided by Wells Fargo, is a great way to manage your money. Users of the app may transfer money, send money, pay bills, and check their account balances. It also includes additional features, such as cardless ATM withdrawals. Users can also manage and redeem rewards on their Wells Fargo Credit Cards.

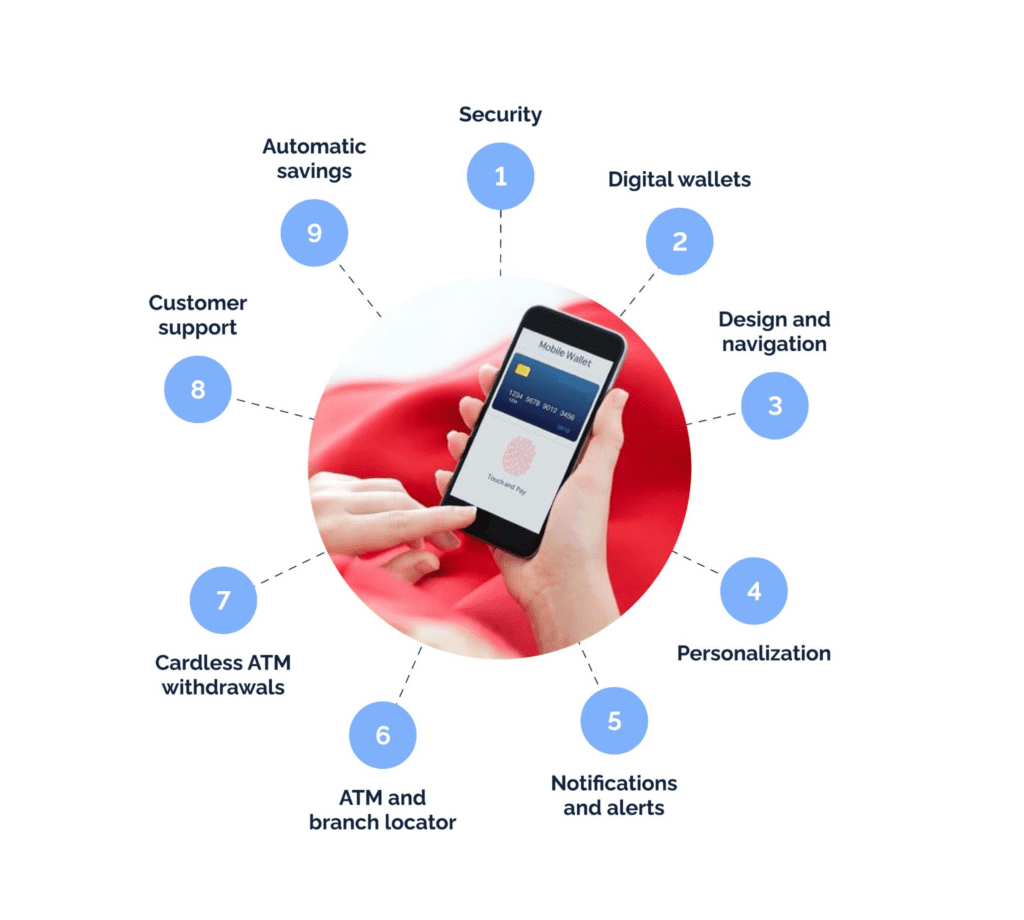

Must-Have Features for Mobile Banking App

Many different attributes come together to make a successful mobile banking app. Features are at the top of this list. It’s important to have the right features in a mobile app to keep users engaged and deliver value.

The features of an app can significantly impact the mobile banking app development cost. This is in addition to the performance and engagement of the user. Let’s take a closer look.

- Secure Login/Registration

This platform’s first and most important feature is providing a safe path for the user. It’s important because hackers, malware, and other undesirable elements will attempt to enter the platform this way. The secure login and registration will make it easy for users to log in and provide a safety net for all platforms.

- Authorization

Today, smartphones have a variety of sensors, including fingerprints and eye scanners. Apps can take advantage of these features for enhanced security via authorization. These sensors are on almost everyone’s phones, and adding them to the app will enhance the user experience.

- Two-step Verification

Each bank account is connected to an email or cell phone number. Important transactions are made more secure by two-step verification. Users making large payments or transfers must use an OTP to confirm their identity. So if you want to integrate this feature into your app, you must hire a dedicated team of developers.

- E-Wallet Integration

Well, eWallet App Development is popular on its own. While everyone uses eWallets on their own, it is a good idea to integrate them with banking apps. This will give users a convenient one-stop solution. Many brands have been doing this in recent years. You should integrate it into your app.

- Bank Account Management

The management of bank accounts is a vital feature. Users can edit, remove, or add information to their bank account. They can, for example, update their addresses and numbers or add beneficiaries.

- Payment Schedule

Some of us may forget to include the date on a bill. The mobile banking app has a feature that allows users to forget about this. Users can schedule payments or, to use a better word, automate them. It saves time, money, and headaches.

- Transaction History

You can’t recall where you spent all your money? With the transaction history feature, users can keep a detailed track of what they have paid and to whom. This is another important feature in mobile banking app development costs.

- ATM Locator

Cash is not completely replaceable, even though the world of fintech is moving towards a cashless system. Users only need to open this feature if they want to withdraw cash. The app will locate the closest ATM.

- Card Management

Cards are a vital part of our financial ecosystem. The mobile app allows the user to cancel or lose a card. The app allows users to set limits, deactivate cards, enable cards, report lost ones, etc. This feature is very important, considering that people often lose their cards.

- Push Notification

Push notifications are essential to keep users engaged and informed of new transactions. They can be reminded about any transaction, withdrawal, or card update.

- Cardless withdrawal

Well, well, well. The cardless withdrawal concept is new, but it’s a welcome one. You can create an ID and pin through the app that anyone can use to withdraw money from an ATM, just as you would with a card.

- Virtual Assistant

AI is a powerful tool that can improve everything. The mobile banking application can be made even better with an AI-based assistant. AI assistants provide 24/7 customer support while also increasing engagement.

- Customer Service

Virtual assistants cannot solve all problems. It is important to include customer service features. It is, therefore, a must-have feature in any mobile banking app.

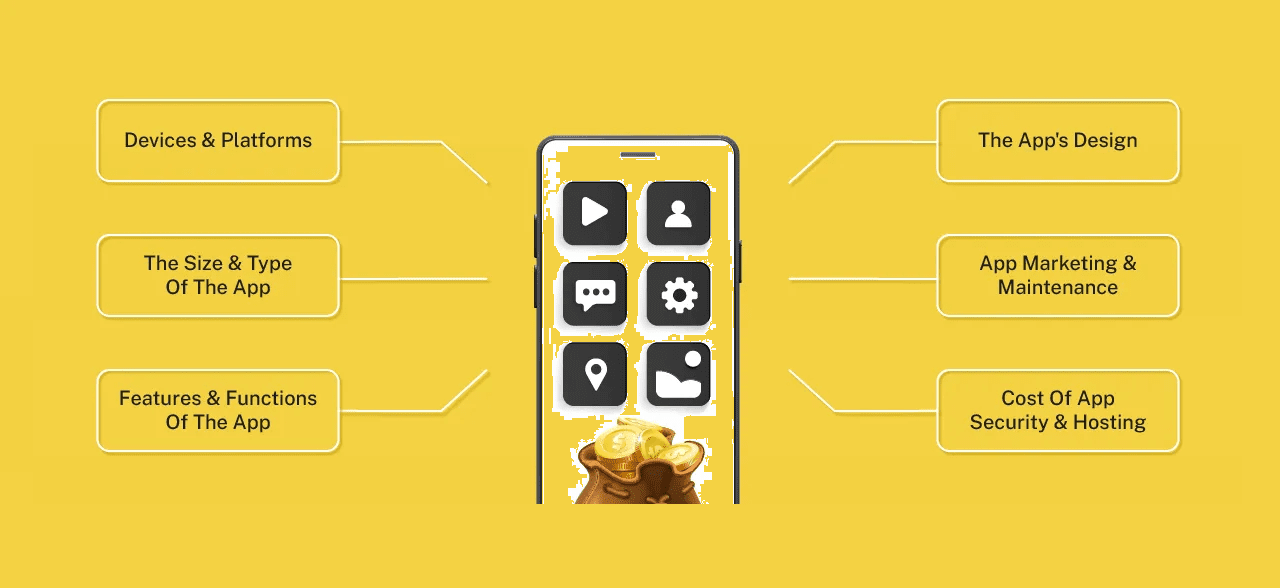

Factors Affecting the Mobile Banking App Development Cost

Several factors affect the mobile banking app development cost for the banking industry. Understanding these factors will help you to determine your budget for the banking app while also giving you an insight into its importance. We’ll go into more depth about these aspects below.

- Wireframe

You can’t skip the wireframing stage when designing a mobile app. A wireframe is the architectural map or design of a banking app. It is created using tools such as Figma or PhotoShop. Wireframes are usually subjected to multiple tests before they can be finalized. A wireframe design costs between $8,000 and $10,000.

- UI/UX Design

After wireframing, UI/UX is a crucial component that might influence your app’s success or failure. The information in a mobile banking app includes account information, details of money transfers, information about customer service, a chatbot, and more. A design that tries to contain all the required information may be made quickly. A minimalistic design is needed to ensure smooth navigation and engage the audience.

- App Platform

The platform that powers the mobile banking application impacts its cost. Although the platform does not affect the mobile banking app development cost, most prefer to begin with Android due to its large user base. You can build your app for one platform first and then move on to cross-platform development when the app has gained traction.

- Team Size

The next step in your project is hiring a dedicated app developer team. This will ultimately impact the mobile banking app development cost. You can hire freelancers to work on your project or outsource it to a reputable on-demand app development company if in-house development isn’t an option.

You can reduce your app budget by hiring freelancers. Their lack of experience and technical expertise in developing banking apps can cost you more than your overall development costs. While a full-service banking app development company might cost a little more upfront, they will provide exemplary services that will ultimately pay off.

- Location of the Agency

| Location | Rates of Hourly Development |

| US | $70-$89 |

| Western Europe | $60-$90 |

| Australia | $30-$60 |

| Eastern Europe | $50-$55 |

| Asia | $15-$25 |

The company location that develops your mobile banking app will also affect the cost. App development costs increase as you move westward.

The US has a higher average hourly rate for mobile banking app developers than those in Asian and African countries. We will show you how much mobile banking app development costs in different regions worldwide.

- App Maintenance

The cost of app maintenance is not the least important factor in determining your budget for an app. It’s not enough to just deploy an app; it is also important to keep it running continuously. Given the sensitive nature of user data and activity, the mobile banking industry is more critical than ever regarding app maintenance.

- Technology Integration

Technology integration is another key factor that has an impact on app development costs. We recommend adding new technologies such as AI or Blockchain to future-proof the banking app. However, your entire budget may be significantly impacted by this.

How Much Does Mobile Banking App Development Cost?

The mobile banking app development costs range from $10,000 to $25,000. This depends on the way it is developed. Costs may vary depending on how many features you want to include in your app.

| Banking App Type | Estimated Cost | Time frame |

| Simple app | $8,000- $15,000 | 3 to 6 months |

| Medium complex app | $15,000-$20,000 | 6 to 9 months |

| Highly complex app | $20,000-$25,000 | 9+ Months |

The complexity of the app will also determine its cost and decline. You may be working with a development team with various expertise. The complexity of the design, integrations, and functionality will determine the mobile banking app development cost. Hire a dedicated developer to overcome the challenges of developing mobile banking applications.

Conclusion

Mobile banking applications are widely used. Users may access their bank accounts and other financial items using these apps. This blog covered many topics, including mobile banking app development costs.

Now, all you need to do is contact a mobile banking app development company if you want to create your mobile banking applications. However, you may also hire on-demand app developers who can create the finest applications ever with the appropriate concept, which can help your business expand and generate a ton of income.

FAQ

1. What is the Cost of Hiring a Developer to Work on a Banking Application Project?

The cost to hire a developer can vary depending on the developer’s experience, location, and skill level. The average cost of hiring developers is $15-$25.

2. How Do You Build a Mobile App for Banking?

Before developing a mobile banking app, it is important to collect the initial requirements. You should also conduct a market analysis. Starting with an application prototype, you must implement the app design and write the code before deploying the app on the market. The next stages of development include quality assurance, app maintenance, and other phases.

3. Can the Cost of Creating an MVP for a Mobile Banking App be Reduced?

By designing an MVP, you may lower the overall mobile banking app development cost. The banking app’s MVP may have the following features:

- Profile creation

- Handling of accounts

- Customer service

- Remote access

- Safe financial transfer

- Using push notifications

- ATMs are located

4. How Secure are Banking Apps?

Security features are built into banking applications to safeguard customers’ sensitive financial data. But it’s crucial to realize that no solution is fully risk-free. While banking applications work to maintain security, if the right steps are not followed, possible weaknesses might be exploited. Mobile banking apps use encryption, secure connections, two-factor authentication, and security assessments to ensure data security.