As have many other businesses, the banking industry has benefited greatly from advances made possible by artificial intelligence (AI). The creation of chatbots with ChatGPT models is one of the noteworthy advancements in AI.

ChatGPT in banking industry, based on the GPT-3.5 architecture, has emerged as a powerful tool for transforming how banks interact with their customers, streamline processes, and enhance overall efficiency.

In the banking industry, where customer service and operational efficiency are paramount, ChatGPT has found its place as an invaluable asset. This AI-powered chatbot offers a range of capabilities that enable banks to provide personalized assistance, offer product recommendations, streamline transactions, detect fraud, and much more.

ChatGPT has evolved into a flexible tool for enhancing the customer experience and streamlining banking processes thanks to its contextual awareness and natural language processing skills.

In this blog post, we will explore the top 10 use of chatgpt in banking industry. From customer support and financial planning to fraud detection and voice-activated banking, we will delve into the transformative impact of ChatGPT and how it has revolutionized how banks engage with their customers.

So, let’s dive into the exciting world of ChatGPT in the banking sector and uncover its myriad possibilities.

What is ChatGPT?

| Launch date | November 30, 2022 |

| HQ | San Francisco, California |

| People | Sam Altman (CEO, co-founder), Greg Brockman (chairman, president), Ilya Sutskever (chief scientist), Elon Musk (co-founder) |

| Business Type | Private |

| Industry | Artificial intelligence |

OpenAI created the AI language model known as ChatGPT. The architecture it is built on is called GPT-3.5, or “Generative Pre-trained Transformer 3.5.” The model may provide replies to queries or prompts that resemble those of a human since it has been trained on a sizable amount of text data from the internet.

ChatGPT is designed for conversational purposes and can engage in dialogue with users across various topics. Natural language writing may be understood and generated by it, and contextually appropriate and coherent replies can be provided. The model has been improved to be interactive and to offer enlightening and useful responses.

It’s important to note that while ChatGPT development can generate impressive and contextually appropriate responses, it doesn’t possess a real understanding of consciousness. It operates purely based on patterns learned from the training data and may sometimes produce inaccurate or nonsensical answers.

Market Stats of ChatGPT

- In June 2023, 10.8 percent (or a total of 4.7 million) of the employees in companies worldwide had used ChatGPT at work. The AI-powered tool was used by 4.7 percent of users who had stored confidential corporate data.

- According to Temenos, 77% of banking executives think that AI will determine the success or failure of banks. According to McKinsey’s Global AI Survey, 2021, 56% of respondents reported AI use in at least one role.

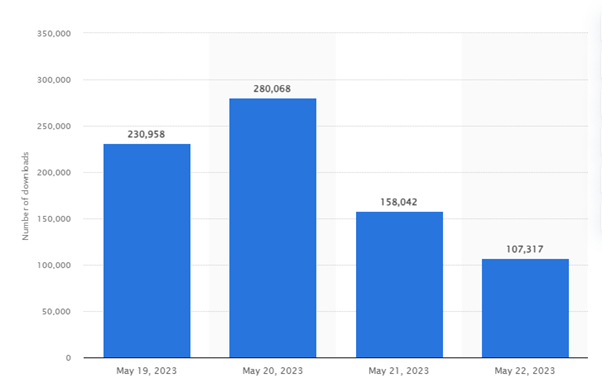

- The Apple App Store saw over 230 000 downloads on its first day.

- ChatGPT has set a new record for the fastest app to reach 10.1M+ active users. It reached this milestone in just two months.

- OpenAI predicts that ChatGPT could make $200 million this year and $1 billion by 2024.

- Microsoft’s $10 billion funding round valued OpenAI at $29 billion.

10 Use Cases of ChatGPT in Banking Industry

Integrating AI-powered chatbots, such as ChatGPT, has significantly transformed the banking industry, enhancing customer service, automating processes, and improving overall efficiency. Here are the top 10 chatgpt use cases in banking in industry:

1. Customer Support and Assistance

The first use case for ChatGPT in banking industry is customer support and assistance. An always-on virtual assistant called ChatGPT responds to consumer questions quickly and accurately. It may respond to frequently asked queries, walk users through different banking procedures, and provide tailored suggestions based on preferences and past transactions.

ChatGPT can comprehend client inquiries and conversationally deliver pertinent information using natural language processing and machine learning. This lessens the strain on human customer support representatives, speeds up response times, and raises client satisfaction levels in general.

Whether customers need assistance with account-related inquiries, troubleshooting, or general banking information, ChatGPT acts as a reliable and always-available support system, improving the efficiency and effectiveness of customer service in the banking industry.

2. Account and Transaction Inquiry

The second point focuses on how ChatGPT In Banking Industry can assist customers with their account and transaction inquiries. With its ability to access customer account information, ChatGPT can swiftly provide relevant details such as current balance, transaction history, pending payments, and other account-related information.

Customers no longer need to master challenging online banking interfaces or wait for customer support representatives to answer their questions. ChatGPT enhances customer satisfaction and reduces the burden on human agents by offering real-time and convenient access to account information, freeing them up to handle more complex tasks.

Moreover, by leveraging natural language processing capabilities, ChatGPT can understand and interpret user inquiries accurately, ensuring precise and helpful responses to account and transaction-related questions.

3. Product and Service Recommendations

By leveraging customer data and analyzing their financial behavior, transaction patterns, and demographics, ChatGPT can offer personalized suggestions for banking products and services. For example, based on a customer’s spending habits, it can recommend suitable credit cards, loans, investment options, or savings accounts that align with their financial goals.

This level of personalization helps customers make informed decisions and presents an opportunity for banks to increase cross-selling and upselling. ChatGPT can effectively match customer needs with relevant banking offerings by leveraging AI-driven insights, enhancing customer satisfaction, and driving business growth.

4. Fraud Detection and Prevention

The next use case of chatgpt in banking sector is fraud detection and prevention. The chatbot can continuously monitor consumer transactions and spot fraudulent activity using AI capabilities. It analyzes patterns, detects anomalies, and flags potential fraud cases in real-time.

When unusual behavior is detected, the chatbot can immediately notify customers, alerting them to the potential threat and providing guidance on necessary actions to secure their accounts. This proactive approach helps mitigate financial losses for customers and the bank while reinforcing trust and confidence in the banking institution.

By employing ChatGPT for fraud detection and prevention, banks can significantly enhance their security measures and protect their customers and financial interests.

5. Financial Planning and Budgeting

ChatGPT can help you plan your finances and manage your budget effectively. Analyzing your spending patterns and financial behavior can provide personalized recommendations to save money and suggest investment strategies.

The chatbot can also create customized budgets based on your income and expenses. So if you want to integrate chatbot into your application, then you must hire dedicated developers. ChatGPT can help you whether you want to save for a particular objective or improve your financial situation.

It can offer insights on where you can cut costs, how to optimize your savings, and even provide tips on managing debt. It can help you better understand your financial condition and make decisions that will protect your financial future.

6. Loan and Mortgage Application Support

The next point focuses on how ChatGPT In Banking Industry can make the process of applying for loans and mortgages easier for customers. When someone wants to apply for a loan or mortgage, they often have many questions about what documents they need to provide, whether they meet the eligibility requirements, and how to submit their application.

Customers may use ChatGPT as a qualified assistant who will walk them through every stage of the procedure. It can answer their queries, provide clear instructions on the necessary paperwork, explain different types of loans and mortgages, and assist in applying.

So if you want to develop a loan and mortgage application for your venture, then you must take assistance from mobile app developers. By automating this process, banks can save time and reduce errors, while customers benefit from a smoother and more user-friendly experience.

7. Account Opening and Onboarding

The next point depicts how ChatGPT can simplify the process of opening a new bank account and guiding customers through the initial steps of joining a bank. When someone decides to open a new account, they often have questions about what documents they need to provide, what types of accounts are available, and what features each account offers.

ChatGPT can act as a virtual assistant, providing clear and step-by-step instructions on what documents are required, explaining the different types of accounts, and highlighting the features and benefits of each one. By automating this process, ChatGPT makes it easier for customers to open accounts and reduces the need for human intervention, saving time and effort for both customers and banks.

8. Automated Payments and Fund Transfers

With the help of this AI chatbot, customers can automate their routine payments, such as utility bills or monthly subscriptions, without manually initiating each transaction. They can also schedule recurring payments, ensuring timely and hassle-free payments.

Additionally, ChatGPT can send real-time notifications to customers, keeping them informed about the completion of their transactions. By automating these payment processes, the chatbot makes banking more convenient and efficient for customers, freeing them from the constraints of traditional banking channels and allowing them to manage their finances with ease.

9. Financial Education and Tips

The chatbot is a knowledgeable guide, offering insights on saving strategies, investment options, debt management, and general financial literacy. It engages customers in meaningful conversations, answering their questions and providing useful advice tailored to their needs.

The chatbot assists clients in making financially educated decisions by arming them with financial information. Whether it’s understanding different investment opportunities or learning how to manage debt effectively, ChatGPT in banking industry acts as a virtual mentor, assisting customers in enhancing their financial well-being.

The chatbot fosters trust and loyalty between the customers and the bank through personalized recommendations and educational content.

10. Voice-Activated Banking

It means that customers can interact with the bank’s services using their voice through devices like smart speakers or voice assistants. Instead of typing or navigating through menus, customers can speak their requests or commands to perform tasks such as checking their account balance, making payments, or getting information about their transactions.

Voice-activated banking offers a hands-free and convenient way for customers to access their accounts and complete transactions, making it more accessible for people who prefer voice interactions or have limited mobility. chatgpt in investment banking enhances the experience by providing a seamless and intuitive interface between customers and their financial services.

Benefits Of ChatGPT in Banking Industry

There are many benefits to using ChatGPT in banking industry. These include enhanced customer support and service, the capacity to manage intricate financial objectives and investment choices, and the possibility for cost savings and productivity gains through automation.

- Personalized Customer Service: One of ChatGPT’s main advantages is its capacity to offer individualized client assistance and service. ChatGPT can provide real-time help and support to customers by swiftly and precisely analyzing massive quantities of data and responding to their inquiries. This can result in increased client loyalty, less customer turnover, and improved customer satisfaction.

- Help at Decision Making: ChatGPT’s capacity to manage intricate financial objectives and investment choices is another advantage in the banking sector. ChatGPT can assist financial advisors and investment managers make knowledgeable choices about their customers’ portfolios by utilizing machine learning to analyze data and deliver insights. These judgments can consider various aspects, including risk tolerance, investment goals, and market movements.

- Automation: ChatGPT can use automation to assist financial organizations in cutting expenses and boosting efficiency. ChatGPT in banking industry may lower expenses and boost productivity by automating mundane processes like customer service queries so that human resources can be used for more sophisticated and strategic jobs.

Future of ChatGPT in Banking Industry

As the artificial intelligence program continues to evolve, it has continued potential to improve several aspects of the Financial Industry.

With customer service being a high priority, the ability to provide 24/7 assistance is something banks can use to set themselves apart from their competition. ChatGPT in Banking Industry’s advanced algorithms can analyze large amounts of data and provide customers with real-time information and suggestions.

If a bank can offer that service to its customers or if that information can help bankers make decisions, that is another huge advantage for the future of banking. Finally, ChatGPT’s potential to reduce risk is a big motivator for banks to consider implementing the technology. The more secure a bank is, the more likely customers will gravitate toward it.

With artificial intelligence impossible to ignore, there are many future impacts ChatGPT can make in the banking industry.

Conclusion

The integration of ChatGPT in the banking industry holds immense potential, particularly in customer support, personalized recommendations, and fraud detection. With the rise of banking app development, incorporating ChatGPT can revolutionize customer experiences by providing instant and accurate responses, tailored financial guidance, and enhanced security measures. As technology advances, ChatGPT can reshape how customers interact with banking services, paving the way for a more efficient and user-friendly banking experience.

FAQ

1. How Can IoT be Used in Fintech?

The network of actual machines, automobiles, and other physical items that are connected to the internet and can gather and share data is known as the Internet of Things (IoT). IoT may be utilized in the fintech sector to collect consumer behavior and preferences information, allowing financial institutions to provide more specialized goods and services.

2. Is a Chatbot a Fintech Product?

Though they are frequently employed in the financial sector, chatbots and virtual assistants like ChatGPT are not always regarded as fintech products in and of themselves. Instead, they are a type of artificial intelligence (AI) technology that may be applied to boost the efficacy and efficiency of financial services.

3. Is ChatGPT Secure for Handling Banking-Related Information?

Yes, ChatGPT may be built with strong security features to guarantee the privacy and accuracy of data relevant to banking. Strong access rules and data encryption might be used to secure sensitive data.

4. Will ChatGPT Replace Human Customer Support Agents in Banking?

ChatGPT is designed to augment human customer support, not replace it. It can handle basic and repetitive inquiries, but complex or sensitive issues may still require the expertise of human agents. The goal is to collaborate seamlessly between ChatGPT and human agents to provide efficient and effective customer support.

5. What Are the Limitations of ChatGPT in Banking Industry?

ChatGPT has limitations such as a lack of real understanding, potential biases inherited from training data, and the possibility of generating inaccurate or nonsensical responses. It requires careful monitoring, ongoing training, and human oversight to ensure the accuracy and appropriateness of its interactions within the banking industry.