We will demystify eWallet creation and help you to embrace the digital revolution. Our guide is for everyone, whether you are a tech-curious pioneer or a coding expert. It will help you build an eWallet App and bring your financial goals to life one pixel at a time.

Learn how to navigate the maze of modern payment solutions using expert insights, sleek design, and user-centric functionality that will help you stand out in a crowded online landscape. Join us to explore the world of seamless transactions, uncompromising security, and future-forward innovations reshaping how we interact with our money.

Change how transactions are carried out and create the path to financial freedom. In 2023, the eWallet will be more than just an app.

It will also be a testament to your creativity and a portal to the future. Are you ready to start this thrilling adventure? Let’s get started! build an eWallet App and be a part of shaping the financial landscape.

What is a Wallet App?

A wallet app is an electronic tool that allows users to store, manage and transfer various currencies, such as cryptocurrencies, digital tokens, and fiat currency. The wallet app allows users to track their balances, make and receive payments, and view transaction history.

Apps that store sensitive financial data often include encryption and authentication. They can be used to make everyday purchases, for investment and trading, in the case of cryptocurrency. The app’s features and user-friendly interface allow individuals to take control of their finances and participate in the changing landscape of digital and virtual currency.

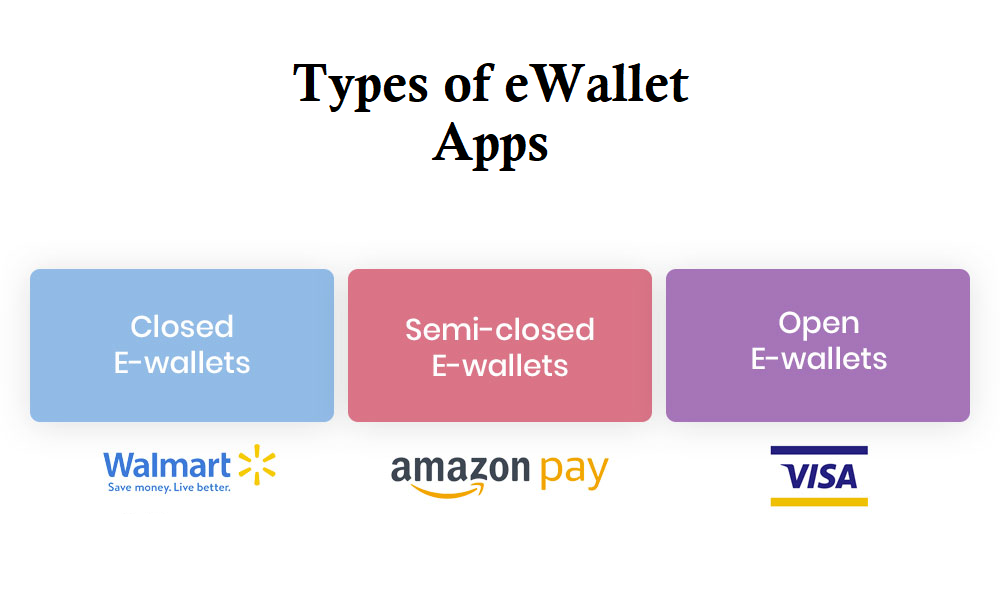

Types of eWallet Apps

Over time, eWallet applications, including the innovative build an eWallet app, have evolved to meet the needs of different users and industries. Here are some of the most popular eWallet applications:

1. Consumer eWallets:

The most popular eWallets are those that people use for their daily transactions. These apps allow users to manage their finances, store payment information, and make online and offline purchases. PayPal, Google Pay, Apple Pay, and Samsung Pay are examples.

2. Mobile Banking Apps:

Many traditional banks offer their own eWallet app with various financial services, including checking your balance, transferring money, paying bills, and managing accounts. These apps are often integrated with existing online banking services.

3. Apps for P2P Payment:

Apps that facilitate payments between people are a vital feature of peer-to-peer apps. Users can send money to family and friends, split bills, and request payment. Venmo Cash App and Zelle are examples.

4. Retailer or merchant eWallets

These eWallets are tailored to specific businesses or retailers. Users can use the app to store points, purchase items, or receive discounts. For example, Starbucks, Walmart Pay, and Target Wallet are apps of this type.

5. Cryptocurrency Wallets

These eWallet applications send, receive, and store cryptocurrencies such as Bitcoin, Ethereum, etc. These apps provide a safe way to manage digital currencies and take part in transactions based on blockchains. Coinbase, Trust Wallet, and Ledger Live are examples.

6. Travel and Ticketing EWallets

Some eWallets are designed for the travel industry. They allow users to store boarding cards, tickets, and other travel documents. Some eWallet apps offer booking features for flights, hotels, and other travel services. Apple Wallet for travel and Google Pay are examples.

7. Loyalty and Rewards eWallets

These apps are designed to aggregate rewards and loyalty programs from various merchants. Users can manage and store their coupons, offers, and loyalty points in one location. Stocard, Key Ring, and other examples are available.

8. Government eWallets:

Some governments offer eWallet applications to citizens to receive financial aid, welfare payments, and subsidies electronically. These apps reduce paperwork and streamline the distribution of benefits.

9. Student eWallets:

These apps are designed for educational institutions and allow students to pay their tuition, access their course materials, or make payments related to the study. These apps may integrate with campus facilities and services.

10. Charity and Donation EWallets

These apps help with fundraising and charitable donations. Users can donate to various causes, track donations and receive tax receipts. PayPal Giving Fund, GoFundMe, and other examples are available.

11. Niche eWallets:

Some eWallets cater to legal, healthcare, or real estate niches. These apps offer specialized features to manage payments and transactions in those industries.

8 Popular eWallet Apps

If you want to build an ewallet app then it is crucial to know the best competitors. In this section, we have compiled a list of the top 8 ewallet apps which you must look at to know the strategy.

| Ewallet App | Launch Date | Approximate Downloads | Available Platforms |

| Paypal | December 1998 | 400 Million+ | Ios, Android, Web |

| Venmo | 2009 | 70 Million+ | Ios, Android |

| Cash App | October 2013 | 30 Million+ | Ios, Android |

| Alipay | February 2004 | 1 Billion+ | Ios, Android, Web |

| WeChat Pay | January 2011 | 1 Billion+ | Ios, Android |

| Google Pay | August 2018 | 500 Million+ | Ios, Android, Web |

| Samsung Pay | August 2015 | 100 Million+ | Android (Samsung Devices) |

| Apple Pay | October 2014 | Adoption Rate Undisclosed | Ios |

How To Build An eWallet App?

If you want to build an eWallet app it requires meticulous planning and execution to provide a seamless experience for the user and robust security features. You can hire hybrid app developers to build a successful eWallet application.

Step 1: Conceptualization and Market Research

Start by defining your eWallet’s core features. Research the market trends, consumer preferences, and competitors to identify opportunities and gaps. Decide on your target audience – consumers, business owners, or a niche. Work with the app developer to build an eWallet app, create a project scope, and refine your app’s unique selling point.

Step 2: Designing and User Experience

Hire UI/UX experts to design an intuitive, visually appealing interface for your app that aligns with your goal to build an eWallet app. Focus on intuitive navigation, minimalistic designs, and an efficient information hierarchy. Make sure the design is responsive on all devices and platforms. Work closely with the ewallet app development company developing the app to iterate and refine wireframes and prototyping, taking into account user feedback.

Step 3: Feature development

You can work with your app developer to build an eWallet app and develop the essential features of your eWallet application. These features could include registration, account linking, and balance management. Use advanced security measures such as biometric recognition and encryption, two-factor authentication, and other technologies to protect user data and transactions.

Step 4: Integration of Payment Gateways

Integrate your eWallet with popular payment gateways to allow users to seamlessly build an eWallet app and add funds using bank transfers, credit/debit cards, or digital wallets. Work with the on demand app development company to ensure a secure and reliable payment process compliant with industry standards and regulations.

Step 5: Testing

Test your eWallet application for security, functionality, and performance as you build an eWallet app. Test scenarios include different user interactions, conditions of the network, and edge cases. Before moving forward, address any bugs, glitches, or vulnerabilities.

Step 6: Launch and Marketing

Coordinate with the app developer to launch and build an eWallet app in major app stores. Create a marketing strategy to promote your app. Include social media campaigns, partnerships with influencers, and press releases. To attract users, highlight the unique features of your app, its security measures, and its benefits.

Step 7: User feedback and iteration

Encourage users to give feedback and reviews as you build an eWallet app. It will help you identify areas that need improvement. Work with the ewallet app development companies developing the app to analyze user feedback and improve the features and design of the app. Update the app continuously to enhance user satisfaction and remain competitive.

Step 8: Scalability & Future Enhancements

Plan for scalability as you build an eWallet app that grows in popularity by optimizing the server infrastructure and database. Add advanced features like peer-to-peer payments, loyalty programs, and integrations with emerging technologies like blockchain and AI.

Step 9: Updates to security and compliance

Update your app’s safety protocols regularly to stay on top of any potential threats. Keep up to date with industry regulations and requirements for compliance with financial transactions and data collected by users. Work with the app developer to maintain a safe environment and implement any necessary changes.

Step 10: Customer Service and Maintenance

Customer support is essential to addressing user questions, resolving issues, and ensuring a positive customer experience. Engage in proactive maintenance of the app to fix bugs and optimize performance. Release new updates. Keep a close relationship with the app developer to keep your eWallet application competitive and current.

How Much Does It Cost To Build an eWallet App?

Ewallet app development cost can vary greatly depending on several factors as you build an eWallet app. These include the features and complexity, the platforms you are targeting (iOS or Android), the location and rates of the development team, the design requirements, security, and integrations with payment gateways and third-party services. Here are some essential cost factors to take into consideration:

1. Development Team:

Most of the money is spent to hire on demand app developers, designers, and perhaps QA testers as you build an eWallet app. Costs will vary depending on each person’s experience, location, and rate. The hourly rate of development teams in different areas is different.

2. Features and complexity:

The more features you add to your eWallet, the more expensive and complex the development process will be. Primary features include registration of users, fund transfers, and transaction history. Costs will rise for more advanced features, such as integration with multiple payment portals, loyalty programs, and multi-currency.

3. Design:

The design of the user interface (UI) and the user experience (UX) are crucial to an app’s success as you build an eWallet app. The design cost will vary depending on how complex the design is, the number and complexity of screens you have, and if your team provides design services.

4. Security:

Security is paramount for an eWallet application as you build an eWallet app, as it deals with personal data and financial transactions. The cost of developing an eWallet app can be increased by implementing robust security measures and encryption.

5. Integration with Third Party Services

It can increase the cost and time of development if you need to build an eWallet app that integrates third-party services such as payment gateways, APIs, or banks.

6. Testing and Quality Assurance

It is essential to thoroughly test the app before releasing it to ensure it works properly and securely. Manual and automated testing is required, as well as bug fixes and quality assurance processes.

7. Maintenance and updates:

The app will require ongoing maintenance as you build an eWallet app to ensure it is secure, functional, and compatible with the latest operating systems.

8. Marketing and Launch

The costs of launching and promoting an app, as you build an eWallet app, include marketing, app store optimization, and user acquisition.

It isn’t easy to give a specific figure without knowing more about the requirements of your eWallet application as you build an eWallet app. As a rough estimation, the cost of building an essential app for an eWallet could be as low as $8,000 to $25,000 and it can rise significantly if you want a more feature-rich and complex app.

Consider consulting with different app developers, including the need to hire mobile app developers, and getting quotes. Discussing your app’s features and requirements will help you get an accurate estimate. You will better understand the cost of building your eWallet application.

Tech Stack To Build eWallet App

| Layer | Technology Stack |

| Frontend | React Native (for cross-platform) |

| Swift (for iOS) | |

| Kotlin (for Android) | |

| Backend | Node.js or Django (Web framework) |

| Database | PostgreSQL or MySQL |

| Authentication | OAuth 2.0 for user authentication |

| Payment Gateway | Stripe, PayPal, or other APIs for payments |

| Security | HTTPS, Encryption, Two-factor authentication |

| Push Notifications | Firebase Cloud Messaging (FCM) |

| Cloud Storage | Amazon S3, Google Cloud Storage |

| Analytics | Google Analytics or Mixpanel |

| Testing | Jest (for frontend), Jest or Mocha (backend) |

| Deployment | AWS, Google Cloud, or Heroku |

In A Nutshell!

In 2023, crafting an eWallet app demands a meticulous approach. Begin with thorough market research to identify user needs. Opt for a mobile app development company experienced in security and seamless UX/UI. Choose the right tech stack and payment integrations. Prioritize robust security measures and compliance with regulations. Design an intuitive interface and conduct rigorous testing. Launch on popular platforms, focusing on user acquisition and retention strategies. Regularly update and maintain the app to ensure secure, efficient transactions and a competitive edge.

Frequently Asked Questions

Q1. What is an eWallet app?

An eWallet app is a digital platform that allows users to store, manage, and transact funds electronically, providing a convenient and secure alternative to traditional cash and card payments.

Q2. What features should an eWallet app have?

Key features include user registration, fund transfers, transaction history, multi-payment gateway support, biometric authentication, loyalty programs, and robust security protocols.

Q3. How do I ensure the security of my eWallet app?

Prioritize security by implementing encryption, two-factor authentication, regular security audits, and compliance with industry regulations to protect user data and transactions.

Q4. What technologies should I use to build an eWallet app?

Choose a tech stack that aligns with your app’s requirements, including programming languages like Java, Kotlin, Swift, or Python, and integrate secure payment gateways and APIs.

Q5. How can I market my eWallet app effectively?

Craft a comprehensive marketing strategy, including app store optimization, social media campaigns, influencer collaborations, and business partnerships to promote user acquisition and engagement.