“In the world of financial convenience, a payday loan app emerges as a beacon of immediate relief, bridging the gap between dreams and reality.”

– Elon Musk

Financial emergencies can strike unexpectedly in today’s fast-paced world, leaving individuals searching for immediate solutions. Enter the realm of payday loan websites – digital platforms that provide a lifeline to those needing short-term funds.

Are you intrigued by the idea to make a Payday Loan website? Look no further! In this blog post, we will embark on an exciting journey to explore the essential elements and steps involved in crafting a successful payday loan website.

Building a payday loan website opens doors to a world where you can offer individuals a way to bridge temporary financial gaps quickly and conveniently. Imagine being a guiding light for those facing unexpected medical bills, car repairs, or unforeseen expenses that demand immediate attention.

This blog post will delve into the fundamental aspects of making a Payday Loan Website, including user-friendly interfaces, robust security measures, seamless application processes, and efficient loan approval mechanisms. We will also review the significance of adhering to legal and regulatory requirements and using responsible lending practices.

So, let’s embark on this informative voyage together as we unravel the secrets to making a payday loan website through this website development process guide that empowers borrowers and provides a reliable financial solution in the modern era.

What is a Payday Loan Website?

Payday loan websites are online platforms that offer short-term loans for individuals who need Cash immediately until their next paycheck.

These loans are usually high-interest and designed to be paid back quickly – often within weeks or months. Online payday loan applications are usually simple and allow borrowers to specify a loan amount and provide personal and financial details.

After approval, the money is often put into the borrower’s account within a few days. Payday loans are often associated with predatory lending and can trap borrowers into a debt cycle if they’re not used responsibly. The terms and conditions should be carefully read and understood before using these websites.

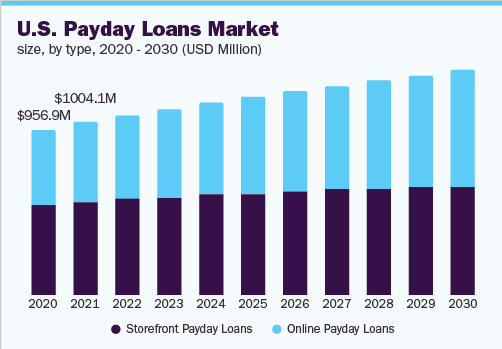

Current Market Stats of Payday Loan

Image Source: www.grandviewresearch.com

- 70% of respondents in the U.S. said that payday loans need to be more regulated.

- The market for payday loans was estimated at $32.48 billion globally in 2020, and it is anticipated to increase to $48.68 billion by 2030, with a CAGR of 4.2% between 2021 and 2030. Payday loans are short-term unsecured loans that frequently have high-interest rates.

- In that year, 6.23 percent of respondents aged 18 to 29 stated that they had used a cash advance or title loan shop service in the past 12 months.

- Only 1% of survey participants in 2011 reported having applied for a payday loan six months before the study. Payday loans in the United areas are 4 times more expensive than those with weaker consumer safeguards.

- The typical period of a payday loan is two weeks.

- On average, one in five borrowers default on their payday loans.

Due to this huge demand and popularity of the payday loan system, various Lending App Development Companies plan to grab this profitable opportunity by developing a website for their business.

How Does a Payday Loan Website Work?

To Make a Payday Loan Website, you should know how a payday loan website functions. It is usually a simple process that can easily be summarized into a few easy steps. The borrower must first visit the payday loan company’s website and complete an online application.

Typically, the form will request personal information from the borrower, including their name, contact information, work status, income, and banking information. The website may request extra papers, such as identity or income verification, to confirm a borrower’s qualifications.

The website system will review your information and determine if the borrower is eligible for a loan. Factors such as the borrower’s credit history and income are often considered.

The borrower will be notified if they are approved and receive a loan proposal, which includes the loan amount, the repayment terms, the interest rate, and any fees. The borrower may then accept or reject the offer. If the offer is accepted, the funds are usually deposited in the borrower’s account within a few days, sometimes within just one business day.

The loan repayment is expected on the borrower’s next payday or within a certain period, usually a few days up to a few weeks. At the due date, the lender can automatically deduct the loan balance and associated costs from the borrower’s bank account. The borrower also has the option of paying manually.

Due to their substantial fees and high-interest rates, Payday loan website development is frequently pricey. Borrowers should think carefully about their financial status before taking out a payday loan.

Top 5 Leading Websites for Payday Loan

We have listed the most popular payday loan websites that are doing awesome in the market and have a huge user base. So let’s check out one by one.

1. LendUp

This online lender provides payday loans with a short duration and cheaper APR. They want to help borrowers become better stewards of their money by offering instructional resources. LendUp provides fast and convenient cash advances. They also strive to offer a transparent lending experience.

Borrowers may apply for a payday loan through their website and, if approved, will receive funds immediately. LendUp encourages borrowers towards financial stability by encouraging them to borrow responsibly and build credit.

2. CashNetUSA

CashNetUSA, a popular online payday loan site, allows quick access to cash advances. CashNetUSA allows borrowers to apply for installment, payday, and credit lines through their website. Upon approval, the money is typically put into the borrower’s account the next business day. CashNetUSA provides short-term funding options that are convenient and reliable for individuals who face temporary financial challenges.

3. Check Into Cash

This well-established payday loan site offers both online and in-store lending services. Payday advances, title loans, and installment loans are available to those with short-term financial problems. Borrowers can quickly access funds with a simple online process.

Check Into Cash aims to help bridge financial gaps and provides convenient solutions to those who need immediate Cash. Before making any decisions, it is vital that borrowers carefully review all terms, conditions, rates, and fees. So if you want to make a payday loan website like Check into Cash, you must hire a loan website development company.

4. Speedy Cash

Speedy Cash, a website for payday loans, offers quick and convenient access to short-term loans. Individuals needing financial assistance can apply for payday loans, installment loans, or lines of credit. Speedy Cash allows borrowers to apply quickly online and receive an instant decision.

The money will be put into the borrower’s account the next working day if authorized. With their flexible loan options, they aim to help customers bridge financial gaps.

5. MoneyKey

MoneyKey, an online lender, offers payday loans and other types of loans. They are a lender that specializes in quick funding and approval for those who need short-term loans.

MoneyKey allows borrowers to conveniently apply online for payday loans and have the funds deposited directly into their accounts. Before deciding whether to take out a payday loan with MoneyKey or another lender, it is crucial that borrowers carefully read the terms and conditions. This includes interest rates and fees.

What Are the Benefits of Payday Loan Website Development?

When you make a Payday Loan Website, it comes with several benefits that can be helpful for businesses in the payday lending industry. However, it is vital to know that there are several websites in the market, so to stand out, you need to have new ideas for money lending platform development. Here are some potential advantages:

- Increased Reach: Payday loan websites allow businesses to reach a larger audience and expand their reach. Companies can expand their consumer base by luring borrowers from various geographic regions.

- 24/7 Availability: Unlike brick-and-mortar establishments with fixed hours of operation, payday loan websites are available around the clock. It allows borrowers to receive approvals, access loan information, and submit applications anytime.

- Streamlined Application Process: A well-designed site can make the loan application process more user-friendly and efficient. Online forms can be designed to collect all the information needed efficiently. This enhances the experience for borrowers by minimizing the time and effort required.

- Automated Loan Process: Payday loan websites can integrate automated systems to process and make loan decisions. This can speed up the loan approval process, reduce the need to manually intervene, and improve the operational efficiency of the business.

- Cost savings: An online platform is more cost-effective than maintaining a physical storefront. Rent, utilities, and staffing expenses can be reduced significantly, which could lead to increased profit margins.

Essential Features To integrate into Payday Loan Website Development

Now that you know the benefits to make a payday loan website, let’s jump to the features section that is essential for any website’s functioning. However, it would be better to hire dedicated developers who can help you integrate these features into the website.

1. Sign Up & Profile Verification

We understand that it can be a long and difficult process to apply for and receive approval from payday loans. Sign-up should be easy. It should be possible to link the user’s web account with their account within a few moments.

The loan lending app development should facilitate easy and convenient ways to use for the individual who wants Cash. This will benefit both parties. You should also encourage users to verify their profiles to ensure both parties’ security.

2. Money on Demand

If a person has an urgent need for Cash and can’t obtain it, it will be a major turn-off after a lengthy procedure. Your cash lending website should allow users to request Cash with just a single click. You can choose to either transfer the requested amount of money directly into your bank account, or you can obtain it from the store.

3. Repayment Options

You can implement the repayment options as a business. When the pay cheque is credited into the user’s account, the borrowed amount can be deducted immediately. It is easy for the consumer to track their refund.

Offer the option to pay the amount faster than needed so the customer can clear his debts more quickly. Customers can simply create an invoice if they want to extend payment time. Your money lending website will be one of the most popular instant loan websites.

4. Quick Alerts

Do you have a forecasting website for money lending? Do you need to remind users of their debt repayment? Want to alert users about their upcoming expenses? Do you want to learn more about the money lending site?

Introduced a service in the company? The app’s brief alerts can provide you with all the required information. You may alert consumers instantly if consumers spend more money than they ought to.

5. Freeze/Unfreeze cards

What happens if your customers lose their debit cards? What if your users lost their debit cards? Or was it changed? If this is the case, you should provide your customers with the option to freeze their current cards and allow them to apply for new ones.

It shows that you care about your customers and increase their satisfaction. If a customer wants to unfreeze a frozen card, then the mobile money lending website should be capable of reusing it. Otherwise, you will lose that customer. So if you want to integrate this feature into your website to stand out from others, you must hire PHP developers.

6. Loan Calculator

A loan calculator is another unique feature that you shouldn’t overlook in a money lending website. This feature is useful when the money lending app offers an approximate calculation of how much the customer will owe after interest.

This allows users to make informed decisions. This feature is a blessing for businesses based entirely on long-term loans. This feature saves your team and you from having to calculate the loan amount.

7. Voluntary Tipping

You can use this feature when your application provides money lending for free or charges as little as $1 per month. It will encourage users to tip you according to their convenience.

8. Credit Score Building

Do people spend more money than they have available to reimburse it? Credit score building can help you to deal with such situations. The application allows users to monitor their rent payments to credit bureaus quickly. Credit-building is a great way to build credit. Your business will then know the maximum amount you can loan.

Technology Used to Make a Payday Loan Website

A robust technology stack is required to Make a Payday Loan Website that can securely and efficiently handle complex financial transactions. Here are a few of the most common technologies that can be used to build a Loan website:

| Programming Languages | Java, Swift, Kotlin, and Python |

| Frameworks | Spring, Django, and Ruby on Rails |

| Database | MySQL or PostgreSQL |

| Payment gateways | Stripe, PayPal, and Braintree.

|

| Security features | SSL certificates, two-factor authentication, and encryption |

| Cloud services | Amazon Web Services, Google Cloud Platform, and Microsoft Azure |

| Artificial intelligence | machine learning and artificial intelligence. |

So these technologies can be used to create a robust payday loan website. However, consulting a full stack development company that can help you make a payday loan website with modern technologies like agile methodology would be better.

Steps to Make a Payday Loan Website

How can you make a Payday Loan website that users will love? This step-by-step tutorial will help you to understand the major processes involved in building a payday loan site. We’ll look at them one by one:

Step 1. Write a Project Plan & Requirements

You should first make a plan for your actions to make a Payday Loan website. Describe the steps you took to get the final product. You will find that the more you detail your steps, the better it is for the design and development teams to understand exactly what you are trying to accomplish.

A requirements document is also important. The requirements (specifications), vital to the product development process, play several roles.

- Guidance for the Design and Development Team

- Identify your intercommunication needs.

- Checklists, for example, during meetings or workshops.

- A contract between the design team and the customer (e.g., a supplier agreement) to complete the task.

- Trace the probability that a change will propagate.

- Overview of the product

The document containing the requirements for a product (specifications) usually includes:

- Overview of the entire project

- Needs and goals.

- Target audience.

- Functional requirements and desired features.

- Aesthetic aspects

- Non-functional details.

- Recommendations, prohibitions, and other information.

Step 2. Select Payday Loan Website Development Vendor

The team designing and making a Payday Loan website must be chosen at the following stage. The group you pick to work on your product will have a big influence on how successful it is. Take note of this. The perfect team may be found in a variety of ways.

- Social networks: The best location to research IT firms and agencies is social media. Chat with representatives from these companies to learn about their experience, specifics of the projects, pricing, conditions, etc.

- Rating sites: Rating sites allow you to compare teams based on their ratings and read customer reviews. Sites like Clutch also offer reviews from past clients. You can read about the projects that the team has done in previous years and their outcomes.

- Friends and colleagues: Contact your friends or partners. You can ask them to recommend a design and development company. You can get in touch with them if they have worked with a good team before.

Step 3. Start with MVP Development

Test your idea by building a prototype of your payday loan site. This strategy helps you determine if the product is useful to users if the functionality is right for them if they like the product’s look, etc. The MVP approach is a simple and trustworthy way to confirm that you are doing it appropriately.

Step 4. Conduct Product Discovery

Product discovery follows. Global corporations employ this intricate procedure to develop new items to make a Payday Loan website. This claim describes what has to be done to make items appealing and practical for contemporary consumers.

The procedure is broken down into more manageable and connected sub-processes. Product Discovery is a way to capture the developer’s vision and the audience’s needs and answer important questions about the product.

- Does solving the issue make sense?

- Does the recommended fix work?

- Will consumers adopt and value this solution?

Developers will return to the fundamentals if even one of the questions is answered negatively. Extensive surveys of representatives of the target audience are conducted together with in-depth product property research.

This procedure is continued until the responses to all three questions are affirmative. Consequently, customers will benefit from the product, and the product owner will make money.

Step 5. Create UX Design

After product discovery, you can start UX design. How can you create a user-friendly, easy-to-use payday loan website? You must take assistance from a loan website design company that can create a great UX in order to make a Payday Loan website.

User experience (UX), or design for the user, is the ultimate goal. The aesthetics and functionality of a product should be considered, as well as its price, portability, and overall value. It’s more difficult to conceptualize them and bring them to life.

The appearance and feel of a product are included in UX design, along with all other facets of the user’s experience. UX designers are responsible for designing user interfaces. They describe the interface structure, functionality, and how various components are connected. Their job includes designing the interface.

If the interface works well, it will leave a good impression on the user. Users will likely be disgusted by the interface if the navigation is unintuitive or difficult. A UX designer’s primary goal is to avoid the second scenario.

Step 6. Move to UI Design

How can you make a Payday Loan website visually appealing to users? Create a great UI. The user interface (UI) focuses on all the aspects of a product that make it appealing, such as button colors and styles, visuals, animated typography, graphical widgets, behaviors, and button reactions.

The UI designer’s responsibility is to determine how the user will perceive the product. The UX designer turns their scientific findings and conclusions into an art form. A combination of typography, color, space, and iconography will make it easier for the user to navigate the final application.

Step 7. Do a User Testing

Start testing after the UX/UI is completed. You will want to test how users understand the product at this stage. You should get answers to these questions during the test:

- Does the user know how to use the product properly?

- Does the product make it simple to find the appropriate areas or items?

- Are there any distractions for the user?

- Does the product help users achieve their goals?

Correct all errors and shortcomings after you have received the answers to these questions.

Step 8. Start Payday Loan Website Development

The most important part is now. The design must be turned into a working product. We include the following steps when you make a Payday Loan website:

- Tech Stack and Documentation: You must hire web developers who carefully select suitable technologies for your project. They also create technical documentation describing all user roles, capabilities, and features.

- Website Architecture Plan: The developers act as architects of the website. They carefully choose components to design and build the desired outcome. They choose a technology stack, such as microservices or monoliths, with the appropriate APIs and controllers on the front end. Experts plan the user interface and determine how different parts of it will communicate on the back end.

- Sprints Planning: We carefully consider priority and sequence to lay the foundation for successful website creation. This is the most important stage to ensure that everything works together harmoniously towards our goals.

- Client and Server Development & QA: Client and server components of the website (development of UI elements, API, etc.). Tested.

Step 9. Final Launch

It’s now time to launch your website for payday loans. This process requires you to plan and prepare for each step. Our recommendations for what you should do at this point are:

- Identification of the target audience.

- Unique product packaging creation.

- Create a slogan and timeline.

- Analyze of competitors

- Customer onboarding Creation

- Website Creation

Conclusion

Creating a successful payday loan website requires expertise in web design, development, and compliance with legal regulations.

To streamline the process and ensure a professional outcome, it is highly recommended to hire a reputable website development company with experience that can make a payday loan website for your business. Their knowledge and skills will help you build a secure, user-friendly platform that meets industry standards and attracts potential borrowers.

FAQ

1. How Much Does it Cost to Make Payday Loan Websites?

The website development cost can vary depending on various factors such as complexity, features, design, and development time. However, a basic payday loan website can range from $8000-$15000, while more advanced and customized websites can cost significantly $25000 or more.

2. How Much Time Does it Take to Make a Payday Loan Website?

Payday loan websites can take a variety of time to construct, based on the complexity, level of customization, and developer experience. However, a completely operational payday loan website normally takes 4-6 months to make a payday loan website.

3. What are the Challenges that Businesses May Face When Building a Payday Loan Website?

Compliance with legal regulations, managing customer data securely, maintaining transparency in loan terms and conditions, handling high-risk transactions, and establishing trust with potential borrowers are some challenges businesses may face when building a payday loan website.

4. How to Hire Web Developers for the Project?

Check the portfolios of the company and the developer to ensure you are hiring the best app developer for your project. Find out what technologies and projects the company uses. You should also compare the cost to hire developers to get the best deal.

5. How Do Payday Loan Websites Like Dave Make Money?

Websites like Dave typically make money through a combination of methods, such as charging subscription fees for premium features, earning commissions from partner services or products, and displaying advertisements to generate revenue.