Electronic wallets can make the cashless transactions very convenient with just a single tap. These wallets are all the trend right now, all thanks to the hassle-free payment options and amazing features.

So, if you are planning to build an ewallet app, then you need to compare the development cost in different regions. If you’re curious about the ewallet app development cost in all regions, we’ve got you covered!

In this blog we will discuss the cost of creating mobile wallet applications, factors and some very crucial hidden factors that influence the total development cost.

So, let’s begin!

What is an Ewallet App?

An eWallet app works on different devices that users can link with the internet. Users can enter and save data regarding their bank account, bank card, or ATM card, which lets them use the gadget to pay for things. Digital wallets work best on portable gadgets, but smart phones are also able to get to them. A lot of people use this type on their phones.

You don’t need to take around cards when you browse because digital wallets let you pay with your phone. Users can input and save their credit card, ATM card, or bank account details. This allows them to pay for items with their device. So, if you need to develop a mobile wallet application, you can hire dedicated developers.

Future Predictions and Projections of Ewallet Service

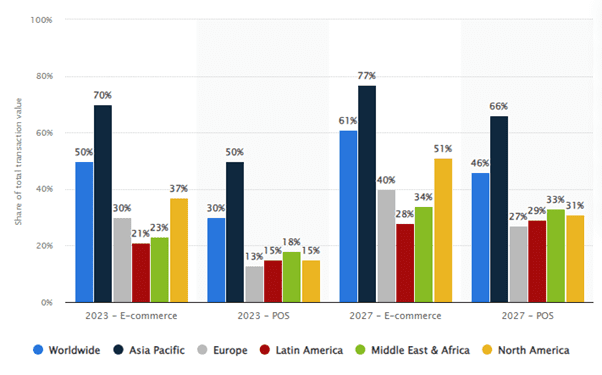

Source: Statista

- Almost 70% of online purchases in the region were made using digital wallets, which is over 20% of all online purchases in Latin America, the Middle East, and Africa. In 2016, less than half of e-commerce payments were made with wallets, but this is expected to increase to 61% by 2027.

- Leading market research firms predict that the global digital wallet market will grow by 22% each year, reaching $8.8 trillion by 2025.

- Data shows that more than 70% of users now utilize some form of digital wallet for payments, a significant rise from just 30% a few years ago, indicating a growing trend in their popularity.

- Among users, 56% preferred Google Pay, 53% chose Apple Pay, and 52% favored Samsung Pay.

How Much Does It Cost To Develop an eWallet App in All Region?

The eWallet app development cost can vary depending on your project requirements. For example, app complexity, features and functionalities, tech stack, platform type, app design and so on. But if you want to know the cost to develop an eWallet application in different regions, then you must check out the below section.

1. eWallet App Development Cost in Ukraine

Ukraine is known for its skilled IT professionals who are also affordable. This makes it a leading choice for outsourcing eWallet app development. The mobile app development cost in Ukraine varies based on the app’s complexity, features, platform type, and the developers’ location. Here is the table of the cost to develop an eWallet app in Ukraine.

| App Complexity | Costs |

| Simple eWallet App | $25000 – $35000 |

| Medium eWallet App | $30000 – $40000 |

| Complex eWallet App | $50000+ |

2. eWallet App Development Cost in UAE

The UAE is now changing the main centre for fintech technologies. There is a high demand for the latest eWallet solutions. Clients in the UAE look for high-quality apps with advanced design features. By understanding local fintech regulations, you can hire dedicated developers to create an eWallet app. Let’s look at the below table of cost of eWallet app development in UAE:

| App Complexity | Costs |

| Simple eWallet App | $20000 – $30000 |

| Medium eWallet App | $30000 – $40000 |

| Complex eWallet App | $60000+ |

3. eWallet App Development Cost in USA

The USA hosts many top tech companies. However, it is also one of the priciest places for developing eWallet apps. An iPhone app development company in the US charges high rates due to their expertise and innovative capabilities. Let’s look at the below table of cost to make an eWallet app in USA:

| App Complexity | Costs |

| Simple eWallet App | $40000 – $50000 |

| Medium eWallet App | $50000 – $80000 |

| Complex eWallet App | $120000+ |

4. eWallet App Development Cost in Australia

Australia is becoming a key player in fintech, especially in digital affordable eWallet app solutions. Businesses in Australia emphasize easy-to-use designs, which need additional development time and resources. Now we will look at the eWallet development cost estimation in Australia:

| App Complexity | Costs |

| Simple eWallet App | $30000 – $40000 |

| Medium eWallet App | $59000 – $79000 |

| Complex eWallet App | $90000+ |

5. eWallet App Development Cost in Japan

Japan is a leader in technology and is known for its innovation and accuracy in software development. Clients in Japan expect top-quality features like NFC, QR code payments, and AI-driven fraud prevention. Let’s have a look at the cost to create an eWallet application in Japan:

| App Complexity | Costs |

| Simple eWallet App | $20000 – $30000 |

| Medium eWallet App | $30000 – $40000 |

| Complex eWallet App | $70000+ |

6. eWallet App Development Cost in Asia

Creating an e-wallet app in Asia includes several factors that affect the total cost. These factors are the app’s complexity, the features it offers, the choice of platform, the design, security measures, and the location and skills of the mobile app development company. Let’s now check out the cost to make an eWallet app:

| App Complexity | Costs |

| Simple eWallet App | $10000 – $15000 |

| Medium eWallet App | $15000 – $20000 |

| Complex eWallet App | $25000+ |

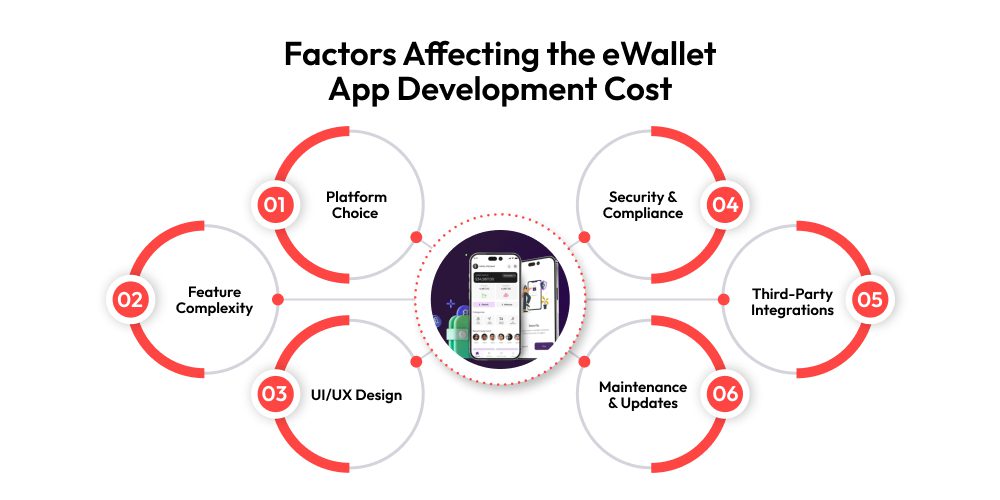

Factors Affecting the eWallet App Development Cost

Factors are crucial in affecting the cost to make an eWallet application. So, we will discuss the crucial factors of eWallet app development in the below section:

1. Platform Choice

Choosing the right platform for your eWallet app is very important. If you develop for just one platform, it can save you money. However, making a cross-platform app can raise the fintech app development cost by as much as 30%. An on demand app development company design for one platform works well for specific market launches, but if you want to reach a wider audience, especially in places like the U.S. where both platforms are widely used, a cross-platform app might be the best choice.

2. Feature Complexity

The range and difficulty of features affect the cost of developing an eWallet app. The basic features are user signup, and history of payment. However, if you want more advanced options like AI insights, or support for multiple currencies, the digital wallet app development cost increases significantly.

3. UI/UX Design

A strong UI/UX design is essential for keeping users. Simple UI can handle basic functions, but advanced UI/UX includes custom animations, stylish looks, and smooth navigation. You can hire on demand app developers who can work more on quality UI/UX design. They may raise the cost of developing a digital wallet app, but it can greatly enhance user interaction.

4. Security & Compliance

Security is crucial for eWallet apps that manage financial information. Basic security features like encryption and simple authentication are standard. However, the best security measures need more funding. Following local laws, especially in the U.S., is important too, as it affects the cost of developing eWallets.

5. Third-Party Integrations

eWallets usually connect with outside services such as banks, payment gateways, and identity verification systems. Each connection has its own cost, which can be a fixed fee or a fee for each transaction. For example, linking to a strong payment processor or supporting several gateways will increase the cost of developing the wallet app. So, it is good to hire Android app developers who can implement your app to third-party systems.

6. Maintenance & Updates

Regular maintenance of your eWallet after launch is essential for security updates, fixing bugs, and adding new features. This affects the overall cost of developing the eWallet app. Annual maintenance keeps your app compatible with the latest operating system versions and security requirements.

What Are the Hidden Costs To Build an eWallet App?

Now that you are well-versed with the factors that affect the eWallet app development cost. Let’s now discuss its hidden custom eWallet app development expenses.

-

User Support and Maintenance

The mobile wallet application needs continuous updates just after it is launched to solve target audience problems and keep it running well. It can cover error fixing, and new feature integrations.

It facilitates full-time support and can be quite expensive and requires an Android app development team who fully works for them. Also, it is best to regularly change and modify the app just to ensure that it works with the new OS systems for eWallet mobile app cost analysis.

-

Infrastructure and Scalability

The backend structure is vital for your mobile e-wallet application. It needs thoughtful planning for effective performance and expansion. If you put money in a flexible infrastructure right from the start, it can support future growth and prevent unnecessary expenses that upgrade down the line.

So, it is great to think about these infrastructure prices, you may build a strong base for your app to manage rising user needs and transaction amounts.

-

Regulatory compliance

Keeping up with financial rules and compliance in different areas can be tricky and costly. Each country has its requirements for e-wallet app data safety and user verification. This means you might need to do more development work and get mobile app developers help to meet the standards in your chosen markets.

To meet these parameters, you often need more certifications. The costs for these measures can increase as regulations change. Additionally, not complying can result in large fines and legal issues, so choose the best cost-effective eWallet development solution.

Final Thoughts

It can be a thrilling opportunity to create a mobile wallet application that brings on multiple revenue streams. But it is vital to have knowledge about the cost of developing a mobile wallet app and some factors for a successful mobile wallet app.

So, if you have set your mind to build an ewallet application for your startup, it is a good option to hire Hybrid developers. They can create a world-class mobile wallet app that fits in your budget.

FAQs

1. How Much Time Does It Take To Create An eWallet Application?

The time to create an eWallet application relies on multiple factors. For example, app intricacy, features, app design, tech stack and so on. Usually, the timeframe of eWallet app development can be between 2 – 8 months.

2. How Much Does It Cost to Build an eWallet App?

The cost to build an eWallet application can range between $10000 – $25000. But it is vital to know that the eWallet app development cost fluctuates with project requirements.

3. How To Create an eWallet Application?

You can develop an Ewallet app just by following the below steps:

- Conduct market research

- Know your competitor apps

- Create a feature list

- Choose the tech stack

- Design the User Interface

- Develop the app’s backend

- Test and launch the app

4. What Are the Tips To Reduce the eWallet App Development Cost?

- Outsource eWallet app development

- Do market research thoroughly

- Build an MVP

- Consider cross-platform development approach

- Use third-party APIs

- Prioritize Essential Features